Australia’s housing market continues to make headlines as mortgage sizes hit a new record high, reflecting rising property prices and increasing borrowing power among buyers.

As interest rates show signs of stabilizing and demand for housing remains strong, more Australians are stretching their budgets to secure a home. This surge in mortgage amounts isn’t just a number—it signals deeper shifts in the economy, affordability challenges, and changing buyer behavior.

Whether you’re a first-time buyer, investor, or just watching the market unfold, understanding this trend is crucial. In this article, we’ll break down what’s driving these record-breaking mortgage sizes, how different regions are affected, and what it could mean for homeowners and the broader Australian economy.

Read More: Aussie Mortgage Sizes Just Broke a New Record

A Final Monthly Snapshot from the ABS

On Friday, the Australian Bureau of Statistics (ABS) released its final monthly housing finance report, which will transition to a quarterly format, with the next update scheduled for February 2025.

This shift marks the end of an era for monthly housing finance insights and places greater focus on longer-term trends moving forward.

A Small Dip in Lending – But the Bigger Picture Holds

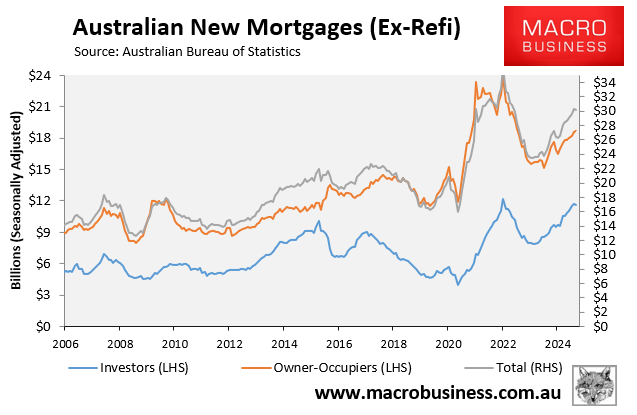

In September 2024, the total value of housing lending fell by 0.3%—its first monthly decline since March. However, the long-term trend remains strong.

Lending to owner-occupiers rose marginally by 0.1% for the month, reflecting a 13.1% increase year-on-year.Conversely, investor lending dipped 1.0% in September, although it remains significantly higher on an annual basis—up 29.5% year-on-year.

The data indicates a cooling in monthly momentum but resilience overall.

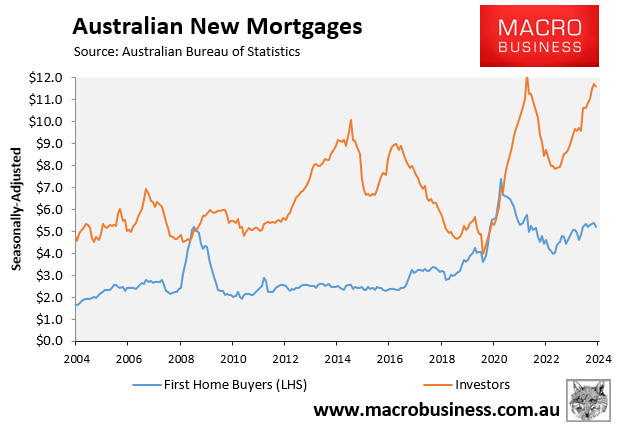

First-Home Buyers Face Growing Headwinds

Lending to first-home buyers (FHBs) saw a noticeable decline, falling 3.3% over the month and rising only 8.8% annually.

This underperformance highlights the ongoing affordability challenges faced by FHBs, who continue to be edged out of the market by more aggressive investor activity.

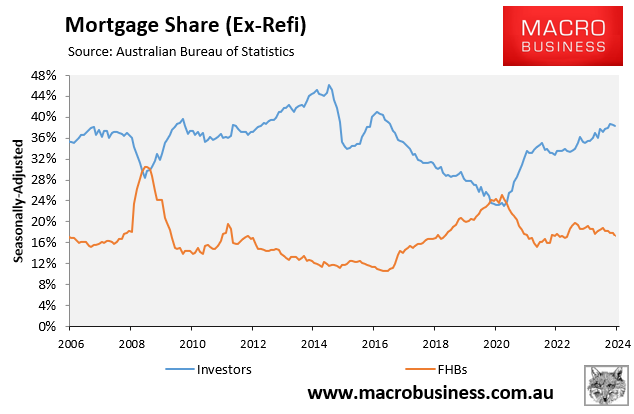

Investors vs First-Home Buyers: A Growing Divide

The latest figures underscore a widening gap between first-home buyers and investors. As investor activity grows, it continues to crowd out FHBs, a trend clearly visualized in lending data.

Investor confidence, likely buoyed by expectations of long-term capital gains, appears to be outpacing affordability concerns that hamper younger or lower-income buyers.

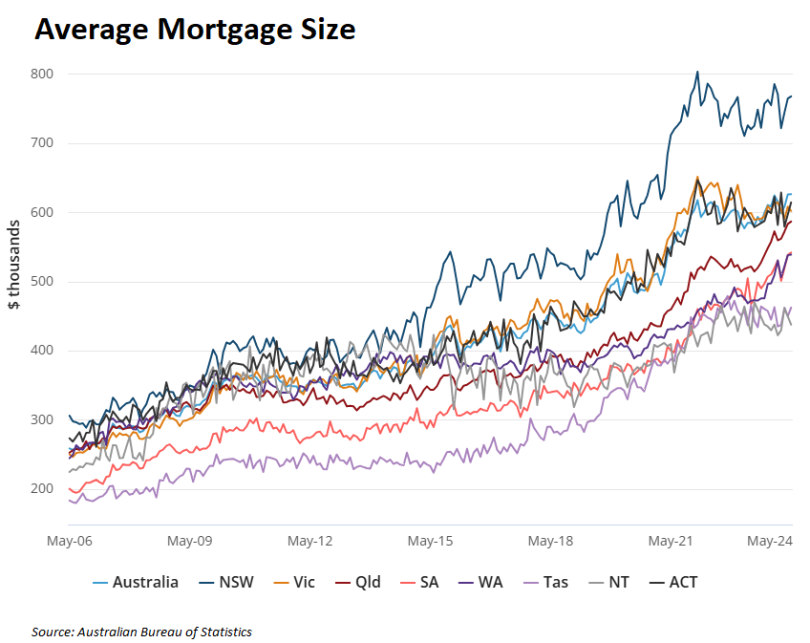

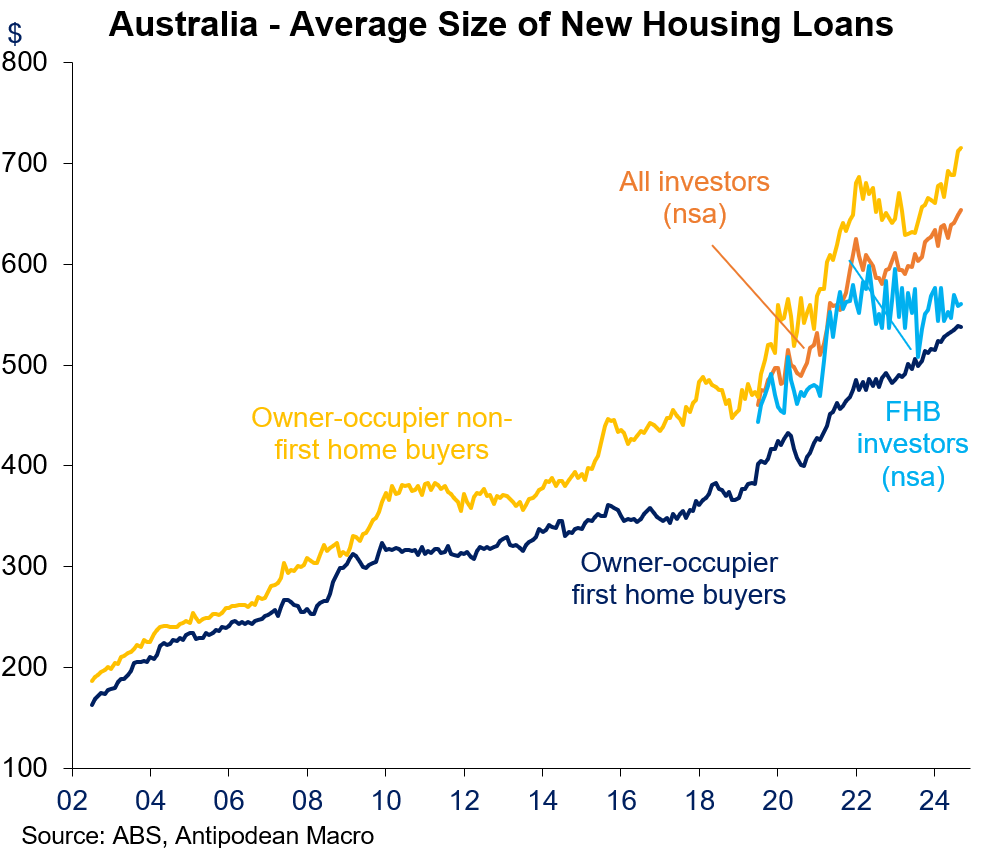

Average Mortgage Sizes Hit Record Highs

Amid softening borrowing volumes, one metric stood out:

- the average mortgage size hit new record highs in September 2024.

- Upgrading owner-occupiers took out loans averaging $711,575, the highest on record.

- Investor mortgages also broke records, averaging $654,056.Even first-home buyers reached a new high, with average loans of $538,210.

These figures, highlighted by economist Justin Fabo at Antipodean Macro, point to growing loan commitments despite elevated interest rates.

Debt-to-Income Ratios Remain Concerning

Australia now carries the highest household debt-to-income ratio in the Anglosphere, as ABS data shows. Despite the highest mortgage rates in over a decade, Australians’ appetite for debt remains strong. This raises important questions about long-term financial resilience and the potential vulnerability of households to rate shocks or economic downturns.

Frequently Asked Questions (FAQs)

Why did average mortgage sizes hit a record high in Australia?

Average mortgage sizes reached new highs primarily due to elevated property prices, sustained demand, and a willingness among buyers—particularly upgraders and investors—to take on larger debt loads. Despite higher interest rates, many borrowers are still leveraging strong income levels and long-term capital growth expectations.

Are first-home buyers being priced out of the market?

Yes, the data suggests that first-home buyers (FHBs) are increasingly being crowded out by investors and upgraders. While FHB loans hit a record high in size, the total number and value of loans to FHBs are lagging behind investor trends.

What does a decline in housing lending mean for the market?

A 0.3% decline in total housing lending in September may indicate short-term caution due to interest rates or macroeconomic uncertainty. However, given the strong annual growth in both owner-occupier and investor lending, the housing market remains relatively robust.

How does Australia compare internationally in terms of mortgage debt?

Australia has one of the highest household debt-to-income ratios in the Anglosphere. This means that Australians, on average, hold more mortgage debt relative to their income than households in countries like the U.S., U.K., or Canada.

Will the ABS continue to report housing finance data monthly?

No. The ABS has announced that it will transition from monthly to quarterly housing finance reporting. The next release will be published in February 2025, which may reduce the frequency of updates but allow for broader analysis.

Conclusion

The latest data from the ABS underscores a significant shift in Australia’s housing and lending landscape. While total housing finance dipped slightly in September, the standout trend is the surging average mortgage sizes, now at record highs across all buyer types.